Bridging the skills gap in the finance industry: Actionable tips for developing talent

Employers cannot find the skills and talent they need – nearly four in five employers globally report difficulty finding the skilled talent they need in 2023, with the financials industry reporting +73% in talent shortage. The finance industry is continuously evolving, driven by technological advancements and changing market dynamics. However, one critical challenge that persists is the skills gap. In this blog post, we explore the skills gap in the finance industry and provide actionable tips for developing talent.

Understanding and bridging the skills gap:

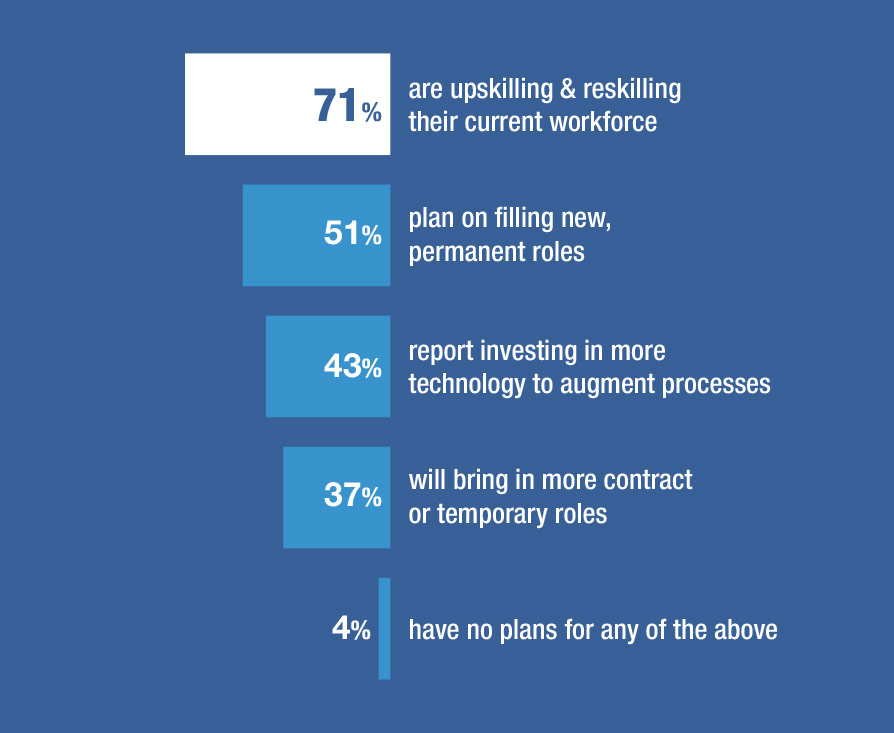

How Employers are Addressing the Skills Gap

Organizations are planning to invest in their people more than ever before.

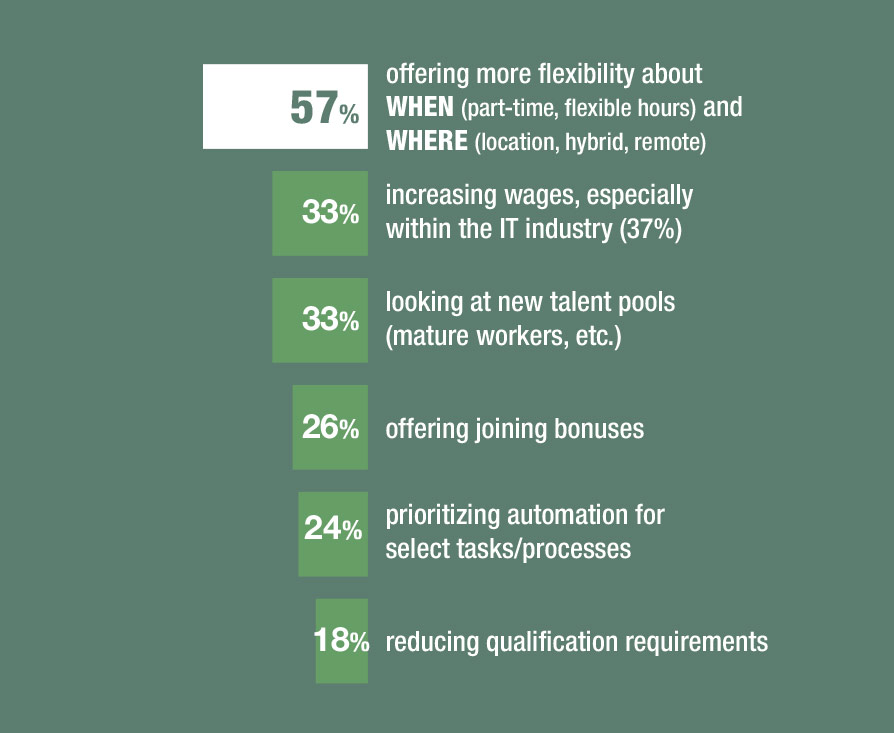

Overcoming Talent Shortages

Nearly 3 in 5 organizations (57%) plan to offer more flexibility in when or where to work as talent scarcity grows.

The skills gap refers to the mismatch between the skills required by employers and the skills possessed by jobseekers or existing employees. In the finance industry, this gap is particularly pronounced due to the complex nature of financial products, regulations and technologies. To bridge this gap, organisations must take proactive steps to develop talent within their ranks.

1. Training programmes:

Implementing comprehensive upskilling and reskilling training programmes is crucial for developing talent in the finance industry. In this era of popular retail investing and the availability of mobile investment apps at our fingertips, it is crucial for professionals at all levels to possess accurate and valuable financial knowledge. Now more than ever, training managers will play a pivotal role in keeping their teams well-informed on the industry’s key topics.

With new technologies come new challenges. Both FINRA and the Financial Services Skills Commission (FSSC) have highlighted the importance of reskilling in the face of new financial technologies. They expect firms to place greater emphasis on financial professionals possessing a basic level of digital literacy, in addition to knowledge of anti-money laundering, issues in senior investing, insider trading and cybersecurity. Despite a shortage of instructors, financial firms are expected to increase their investment in skilled trainers who can equip their teams with the essential expertise needed to navigate cutting-edge tech stacks tailored for a new breed of investors.

Lastly, it is imperative for organisations to prioritise additional training courses that focus on enhancing soft skills such as behavioural awareness, critical thinking, and effective mentoring and coaching. While investing in technology skills is crucial, it is equally important to recognise the significance of interpersonal skills in fostering successful human interactions.

2. Mentorship initiatives:

Mentorship plays a vital role in talent development. Pairing experienced professionals with junior employees allows for knowledge transfer, skill enhancement and career guidance. Mentorship programmes can be established within organisations or in collaboration with industry associations. By fostering a culture of mentorship, organisations can leverage the expertise of their senior employees to nurture and develop talent.

3. Continuing education opportunities:

Continuing education is essential in the rapidly changing finance industry. Encouraging employees to pursue advanced degrees or industry certifications, and attend conferences or workshops helps them stay updated with the latest trends and developments. Organisations can support employees in their pursuit of continuing education by providing financial assistance, study leave and access to relevant resources.

4. Cross-functional exposure:

To develop well-rounded finance professionals, organisations should provide opportunities for cross-functional exposure. Assigning employees to projects outside their immediate area of expertise broadens their skill set and enhances their understanding of the entire financial ecosystem. This exposure also fosters collaboration, innovation and a holistic approach to problem-solving.

5. Performance feedback and recognition:

Regular performance feedback and recognition are crucial for talent development. By providing constructive feedback, managers can identify areas for improvement and tailor development plans accordingly. Recognising and rewarding exceptional performance not only motivates employees but also reinforces their commitment to continuous growth and development.

6. Tapping into the mature workforce:

What do seasoned workers want at work?

- 67% want a four-day week

- 40% want to choose their start and end times

- 76% want a supportive manager

- 66% want to find meaning in their daily work

- 61% want to know their work positively contributes to society.

An increasing number of individuals aged 50-64 years, totalling 3.5 million, have decided to step away from the workforce, leading to an alarming trend of economic inactivity. This group of former employees consists of some of the most experienced and highly skilled individuals in the UK, and their departure is leaving a significant void in the labour market that businesses are struggling to fill across all sectors. The exodus of seasoned workers can be attributed to various factors, such as the lack of flexible work options, overwhelming stress levels, outdated job roles, limited opportunities for career advancement and an imbalance between work and personal life. However, these challenges can be effectively addressed through strategic workforce planning, outcome-focused training and reskilling initiatives, and the implementation of adaptable conditions that promote workplace flexibility.

7. Promoting diversity and inclusion:

Embracing diversity in hiring practices can bring fresh perspectives and a diverse range of skills to the financial industry. Encouraging women and underrepresented groups to pursue careers in finance can help bridge the skills gap by tapping into a wider pool of talent.

8. Flexibility and perks:

The main reason behind this current talent shortage is that the world of work has permanently changed. Alongside a growing skills shortage, employees’ expectations have now changed with the need to have greater opportunities within roles and greater fulfilment at work, in both business and personal terms:

- Work needs to align with their personal values (ESG talent)

- Work needs to be flexible (remote and hybrid working)

- Work needs to be remunerative in more ways than just their pay packet.

The skills gap in the finance industry is a significant challenge that organisations must address to remain competitive. By implementing training programmes, mentorship initiatives, continuing education opportunities, cross-functional exposure and performance feedback mechanisms, organisations can bridge this gap and develop a skilled and capable workforce.

Our network of accounting and finance recruitment consultants recruit for temporary and permanent roles at all seniorities, ranging from accounting support positions and part-qualified accountants through to fully FCCA or ACCA-qualified accountants and senior finance professionals. As a leading recruitment agency, we can identify the right professional, with the right skill set. Our consultants are among the most experienced in the accounting and finance recruitment market – with each member of our team specialising across sectors and qualification levels, you will receive experts with in-depth knowledge of the sector.